No matter how long you’ve been in business, there’s always a jolt to the system once you cross that IPO threshold. But jolts are relative, sometimes a mere tap to make sure you’re paying attention, other times an earth shattering thunder clap that shakes you to your core. When it comes to financial reporting, the level of jolt you experience is largely determined by one single thing – preparation.

So to ensure your reporting is as smooth and worry-free as possible – especially if this is your first time dealing with reporting requirements – we want to take a close look at key filing deadlines for public companies along with a handful of best practices to keep in mind. Coupled with our discussion of the financial reporting and disclosure requirements themselves, you’ll always have a clear vision of what lies down the reporting road for your organization.

First Things First: Filing Status

Before we leap into specifics, you have to know what type of filer you are to begin with. Are you a large accelerated filer? An accelerated filer? Perhaps you're a non-accelerated filer. Now before you start to feel beads of sweat trickling down your forehead, we assure you that determining your status isn't the chore you might think it is. In fact, it's downright easy.

Your public float determines what category of filer you fall within. And, to borrow verbiage straight from the SEC:

"Public float is calculated by multiplying the number of the company's common shares held by non-affiliates by the market price and, in the case of an IPO, adding to that number the product obtained by multiplying the common shares covered by the registration statement by their estimated public offering price."

To translate that into something a bit more palatable, your public float is simply your stock price based on the shares held by non-affiliates or, in simpler terms, anyone that lacks control over you, the issuer. In this case, control equates to causing the direction of management and policies.

Let's say you're a private company going public. You calculate your public float by taking the number of common shares on your registration statement and multiplying it by the estimated public offering price:

Public float = number of (non-affiliate) common shares x IPO price

You'll probably get your share price from your roadshow so, to use a simple example, if you're offering price is $25 and you have 10,000 common shares on your registration statement, then your public float is $2,500,000. And we're off to the races.

Filing Deadlines for Public Companies

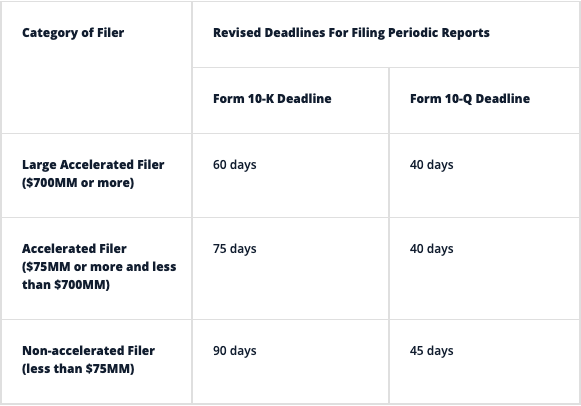

Building on our discussion of public float, let's look at your filing deadlines now. Reporting companies fall into one of three filer status categories, as determined by your public float.

- Large accelerated filer, $700MM or more public float

- Accelerated filer, $75MM or more and less than $700MM public float

- Non-accelerated filer, less than $75MM

Once you determine your filer status, just have a look at this handy dandy chart to determine your reporting deadlines:

And it's pretty much just as easy as that. Your public float determines your filing status, which provides your filing deadlines for Form 10-K and Form 10-Q. However, don't forget that your filing dates are simply the finish lines to races that you must start well in advance. You have to collect the data, prepare your reports, and get executive sign-off and approval by the audit committee.

Best Practice Alert: Create a Reporting Calendar

Since each of those steps has its own time table and internal deadline, there's an immense amount of organization and coordination that goes into every SEC filing. Naturally, this speaks of the importance of having your controls, processes, and systems in place and ready to go when it's time to prepare and file a quarterly report, annual report, or Form 8-K.

Our advice is to create a periodic report calendar that all involved parties can reference to see due dates and where their individual tasks fall within the overall process. Your reporting manager keeps everyone dialed-in and on-track, because all it takes is one bottleneck to throw a wrench into the whole process. And when you have auditors, legal counsel, management, and several others involved, that's a lot of moving parts that have to act in unison.

It takes quite a bit of time for each of these parties to review the draft, make comments, and for you to integrate the comments into the document. So plan ahead, grasshopper, and be sure to touch base with everyone so that you’re all on the same page. Fiscal years have a way of flying by, fiscal quarters even more so. Note how many calendar days it will take for each person or group to accomplish their task, look at your fiscal quarter end date, fiscal year end, and work backwards to see when each task should take place.

Subsequent Events

If certain events occur after your reporting date but before you file, you might also have to disclose those subsequent events on your financial statements, particularly if they require adjustments to your financials. These events might include, amongst other things, a lawsuit, bad debt, a business combination, or sale of equity.

In such a disclosure, you must discuss the impact of the event as well as how you addressed it, all while time is slim and team stress levels perhaps higher than usual. To prevent a subsequent event from wreaking havoc, be proactive in your preparation and draft the required disclosure language ahead of time. That way, even if you don't yet know the final numbers, you can still have legal review the content and approve it, simply plugging in the final data afterward.

Of course, SEC filing deadlines are just one side of the EDGAR coin. You must also understand what goes into each of the reports – Forms 10-K, 10-Q, and the occasional 8-K – but, as you know, Embark has your back on the reporting meat & potatoes as well. Just remember, it pays to be organized and maintain clear communication across your team – and everyone else involved in your reporting, for that matter. And if you need help transitioning to life as a public company, Embark is here to lead you to the market cap promised land.