Scenario planning is like a GPS unit for your company's perpetual road trip. Sure, you can use a roadmap to identify the most obvious routes, but what happens when there are accidents or road construction along the way? That's what makes scenario planning and its first cousin, sensitivity analysis, so essential in these highly uncertain times – they give you the flexibility to pivot toward an alternate route and still reach your destination.

However, many FP&A teams aren't accustomed to integrating so much risk into their financial models. For that reason, we want to take a closer look at scenario planning, what it lends to your financial planning, and discuss some key best practices to ensure you're making the most of scenario planning's strengths.

Variables as Far as the Eye Can See

We wouldn't blame you a bit if you feel a little intimidated these days. After all, it's only human nature. People and organizations both thrive under consistency and familiarity – it's sort of our thing. But when that comfort disappears and variables fall from the sky in a torrential downpour of risk, it feels like you can't see your hand just a foot in front of your own face.

Further, when uncertainty saturates something as critical as cash flow forecasting, for instance, flexibility becomes imperative to navigate the countless twists and turns created by the coronavirus pandemic. Scenario planning is one of a company's best tools to account for that uncertainty, allowing you to build multiple scenarios into your financial modeling to account for different directions based on data that can change on a whim.

Adapt With the Times

Naturally, scenario planning isn't a new concept to accounting and finance teams. The problem companies are running into these days, however, stems from the sheer volume of risk pervading nearly every corner of the marketplace, from operations and labor management to reporting and logistics.

In other words, it's not just a matter of running separate scenarios for your different regions, service lines, or product lines as you would have – or at least should have – in the past. Now, it's about integrating more granular detail into the forecast for each of those business segments.

For instance, if you're an international business that has forecasted your cash flow at the aggregate level in the past, evaluating on a country-by-country basis going forward will help you account for the differing recovery rates across the globe. As of Q2 2020, European countries are generally ahead of the United States in flattening the pandemic curve, meaning those economies are likely closer to some semblance of normalcy which, of course, could also reverse course in an instant.

But if your forecasting lacks sufficient detail, you won't be able to properly account for those staggered recoveries and, therefore, might potentially impact your decision making within a given region. The same premise holds for different products or service lines as well, where you could see a particular product line recover much faster than others under your brand. If your scenario planning doesn't integrate enough detail across your product or service lines, then you won't be able to isolate different impacts on different levels within your operations.

In other words, your scenario planning feeds into and enhances your sensitivity analysis, providing sufficient detail so you can change your inputs and gauge the impact quickly. This way, your decision-makers can incorporate the different trigger points you identify that can affect your profitability.

Once again, this approach can vastly improve your flexibility, making it one of your greatest assets since it gives your business leaders the ability to adapt to the times, react to new information, and better anticipate future events. That's why scenario planning is so important right now – your modeling evolves with every new piece of information, becoming more targeted and relevant as you go.

Fine-Tuning Your Scenario Planning

Okay, that's enough high-level insight for the time being. Now let's roll up our sleeves a bit and see how you can better leverage these tools to chart your path forward.

Expand Your Approach

We obviously don't know how many different scenarios you were already integrating into your financial forecasting. We're pretty darn good here at Embark, but not quite yet clairvoyant. However, if your analysis was a bit on the stagnant side before the coronavirus pandemic – maybe relegated to a best-case scenario, worst-case scenario, and a middle-of-the-road – then doubling or even tripling scenarios in your modeling could very well be a jolt to the system.

However, given the volume and velocity that new information hits the market right now, the more scenarios you plan for, the more flexible and informed your decision-making becomes. And if COVID-19 has taught us anything, it's that the improbable can and does occur.

Therefore, you don't want to completely ignore scenarios with low probability and high impact, like the almost intolerable thought of the pandemic increasing in magnitude and sticking around for another year or two. To that point, when building possible scenarios, there are a few questions that can be extremely useful in leading the way:

- How effective will treatment options be at different points in the future?

- How long will the pandemic have a significant impact on the economy and consumer behavior?

- If you have an international footprint, when do you think your different regional markets will open up?

- What impact has the pandemic had on your supply chain, and what does it mean for your operations?

- How has COVID-19 impacted your customers, and how will it affect your cash flow?

- What effect will the pandemic have on your workforce a month from now? Six months from now?

Sure, given the level of uncertainty right now, those questions are just a drop in the proverbial bucket. But you get what we're going for – think about the different directions things can go, the degree of uncertainty for each, and the economic elements both in and out of your control. Use different combinations of possibilities – the relative success of virus mitigation, recovery times, economic growth, etc. – to formulate your scenarios.

Identify Key Metrics

You might have noticed that we used a few somewhat nebulous terms like "relative success" and "significant" in that previous section. How exactly are you supposed to define something like relative success? Relative to what?

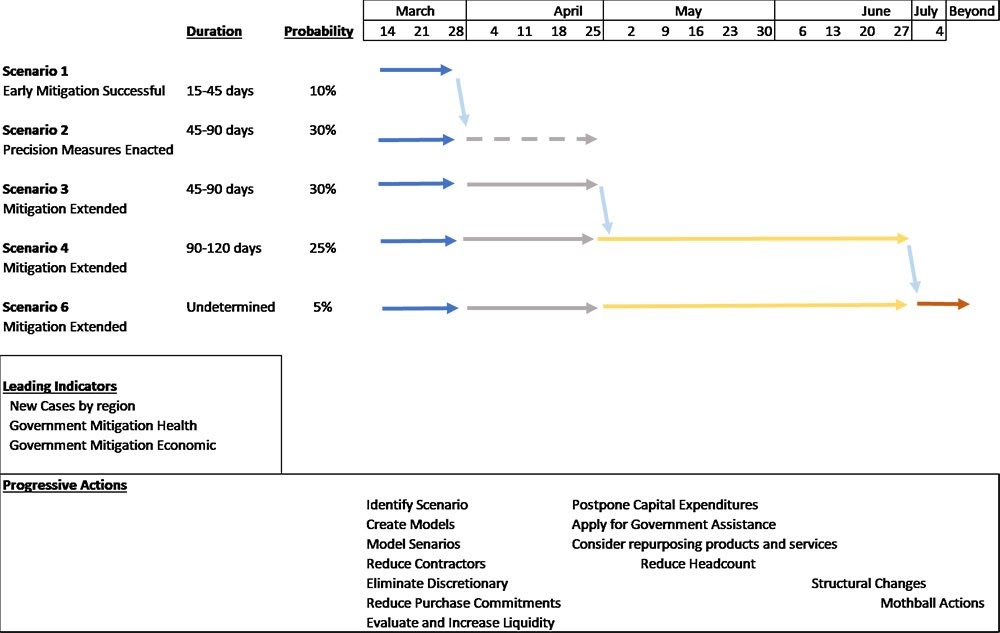

That's why you must also identify particular metrics that will provide context and depth, especially when it's dependent on variables that you wouldn't ordinarily be mindful of in your strategic decision-making process. In your scenarios, leading indicators might include new COVID-19 cases by region, economic stimulus variables and benchmarks, employment figures, and other readily available data points. This type of information will help you define and track key assumptions in each of your scenarios.

Action Planning

You could develop a million different scenarios – something we don't suggest – that integrate precisely targeted insights and details, but still end up spinning your wheels if you don't take action on them. Thus, you will also want to examine the different pivot points within each scenario and determine how to best respond. Sticking with our cash flow example, such pivot points and responses could include:

- Cutting discretionary spending

- Layoffs or furloughs

- Organizational restructuring

- Renegotiating compensation packages

- Revisiting partner contracts

- Asset sales

- Refinancing or restructuring debt

- Diversifying markets and business operations

And that's just scenario planning for your cash flow forecasts. FP&A can take a similar approach when evaluating or projecting your financial earnings, developing risk management and mitigation strategies, or virtually any other decision-based process that can help your enterprise efficiently and effectively deal with uncertainty. In the end, if you created a visual to convey the different scenarios, actions, and possible outcomes, it might have looked something like this:

Teamwork Is Essential

We understand that this all sounds like an awful lot to undertake, especially if your FP&A team isn't accustomed to taking such a deep dive into scenario analysis and planning. The good news, however, is that they are not alone, or at least shouldn't be.

Cross functionality plays a vital role in effective scenario planning. Your FP&A team should be able to rely on input and assistance from other groups within your company, making this level of financial planning a genuinely team-driven effort. Naturally, that means that communication between different departments and groups within your organization is critical to your success.

Fortunately, this is an area where our experience and expertise can be especially helpful, showing you how to develop and maintain the processes and solutions you need to improve your financial planning. Our job – amongst others – is to evaluate your processes from beginning to end and make sure that everything we've discussed is truly institutionalized and absorbed into your operations. That it becomes second nature.

Yes, these are uncertain times, but that doesn't mean you can't effectively plan for the future. It might just require a different approach than you're used to. That's why Embark is such an important partner for companies right now – our expertise is your expertise, and that's a real competitive advantage right now. Put another way, there's a reason why CFOs have us on speed dial.