Updated July 2023

The term “data silo” is such a buzzword now, it seems to have lost a bit of its gravitas. And that’s a real shame. Because in theory, a CFO should cringe at the thought of data silos and the massive constraints they place around an enterprise. Or at least any CFO that wants to propel their organization toward a streamlined, forward-looking future.

But trapped, disparate data hiding across organizations has leadership playing at a lasting disadvantage, a dynamic that’s far more widespread than you might imagine. After all, if you’re only reporting out of a single source, you’re by definition reporting in a data silo. And that’s just one of many instances where financial leadership inadvertently hobbles business intelligence (BI) and constrains growth.

However, as we’re about to discuss, you can stem those inefficient, disconnected data tides through effective financial data management and combining your financial data sources into one. And as an added bonus – you can generate immediate ROI for your efforts. We’ll explain.

What is Financial Data Management?

There’s a lot going on in a typical finance organization. Data is streaming through the enterprise from every direction, giving everything a somewhat unnerving and chaotic feel unless you have a strategy to harness all of it. And that’s where financial data management (FDM) comes into play.

With FDM, you’re implementing a set of digital tools and processes to organize and keep track of all that financial data. Through data analytics, dashboards, automation tools, and specialized software with machine learning and artificial intelligence, FDM lets you vastly improve reporting for your decision-makers, making the entire enterprise more agile and prescient.

Effective data management is especially useful in addressing data streams and sources scattered to the organizational winds, forming silos and bottlenecks everywhere and anywhere. As a matter of fact, this is such a prevalent issue for CFOs and their teams, it warrants a far closer look.

More Data Sources, More Problems for CFOs

Let’s start by painting a picture. You’re knee-deep in a major transformation project, one that includes groups from across the enterprise. IT, HR, accounting and finance, operations, maybe even marketing – they all play a role in this new initiative. Thus, they all bring their own data sets and systems to the party as well.

Assuming you don’t want to spend hours, days, or even weeks toggling between the different CSV files each system spits out, you designate people from your team as the official spreadsheet combiners and data stitchers. And since those people are such team players, they dive into that mountain of data for you, but there are repercussions:

- Due to the possibility of human error, you question the accuracy of the resulting reports

- The time-consuming task takes those team players away from analyzing and innovating

- Entity reports are still going to be in a different place than the manually-stitched consolidated data

- It’s impossible to approximate anything close to real-time financial information

- The process is not replicable, where every iteration or change in data requires a restart

- By the time your team generates the data, it could be days, weeks, or even months old

Obviously, none of those bullet points are good. And collectively, they fall somewhere between massive inefficiency and data management calamity. Remember, a CFO is first and foremost a business partner to the rest of the organization, so such misalignment will inevitably snowball.

Therefore, when you make decisions based on incomplete, inaccurate, and outdated information, you’re not making the best, fully informed decisions possible for the enterprise. That’s going to affect every employee, stakeholder, and business partner in some way – not to mention potential regulatory compliance issues. Hence, the snowball effect.

Further, you’re impeding your own team by saddling them with monotonous, somewhat mind-numbing manual tasks. And what does that mean for your accounting and finance folks? Rather than the financial analyses they thought they’d be digging into when joining the organization, they’re bored, unchallenged, and start to daydream about greener pastures elsewhere. Suffice it to say, none of this is great.

Reporting from Your ERP

Digging a bit deeper, one of the most prevalent examples of siloed data is companies reporting from their ERP. While we’ll be the first to attest to the wondrous powers of a comprehensive ERP system, that doesn’t mean even the best ERP should be your go-to for on-demand financial reporting.

As a CFO, ERP reporting is sufficient as long as close numbers are all you need to guide the ship. But that also means you’re always looking backward rather than forward, leaving the entire enterprise susceptible to even the slightest of jolts coming down the pike.

Want to know what your profitability metrics are in real-time? Or even what you’re buying, selling, and at what price points across your supply chain? Unfortunately, you’re out of luck if you stick to your ERP for financial reporting. And in the bigger picture, it also means you don’t know if your decisions have a positive or negative impact on the business.

In short, you’re perpetually referencing stale data by relying on ERP-based reports, increasing the likelihood you miss the strategic forest through the data trees. Think of it this way – there’s both breadth and depth to your enterprise data. And if you limit yourself on either front – like using an ERP for financial reports – you’ll always make decisions based on a portion of the information you could and should be using.

How Can You Use Financial Data Management?

So what’s a well-intentioned but behind-the-times CFO to do? Well, combining all of those disparate data sources into a single, consolidated reporting infrastructure is a great place to start. And despite what the often intimidating data science lingo might imply, consolidating your data sources isn’t as tough as it probably sounds.

Let’s revisit the previous illustration, just using consolidated reporting rather than separate, disconnected data sets. Now, the reports from HR, IT, operations, and marketing automatically roll into a single set, letting you:

- Trust the accuracy and immediacy of the data, unlocking near real-time decision-making for maximum agility in an ever-changing market

- Free your team for analysis and innovation to create actionable insights

- Access all data, both entity-level and consolidated, from a single source

- Drill further down into data sets in real-time

- Empower employees to more easily create ad-hoc analysis, outside of the standard reporting cadences

Just as importantly, if the project involves rolling transactional systems into a centralized repository – i.e., the mighty data lakehouse – you’re also galvanizing data governance around the process, all while preserving maximum functionality. That, in turn, minimizes the need for heavy-duty scrutiny from internal audit and can help streamline regulatory reporting for SOX compliance.

Climb the Business Intelligence Maturity Curve

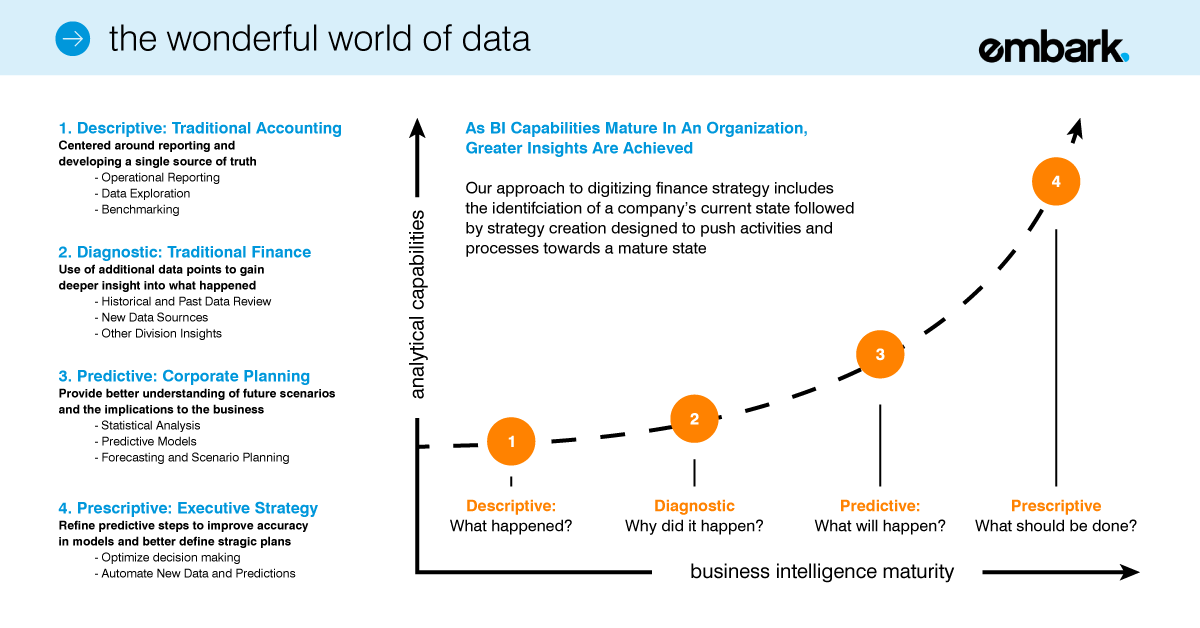

In a broader sense, when you embrace digital finance tools and aggregate multiple data sources, you’re allowing your enterprise to climb the BI maturity curve, moving from descriptive to prescriptive capabilities.

As you can see from the graphic, this essential transition lets you base your decision-making on all available information to drive the business rather than relegating yourself to the past. Naturally, this significantly impacts several areas, particularly financial planning and analysis (FP&A).

In other words, if adding 2% to your last P&L and balance sheet is the extent of your forecasting models, then getting access to the full – once again – breadth and depth of your data will be like walking into data-driven Narnia. By combining your data sources, you can actually look ahead, utilize more nuanced data integration, identify trends, and prepare for different scenarios.

Financial Data Management Best Practices and Insights

Now that we’ve piqued your interest, let’s look at some key FDM best practices and what you can do to combine those pesky data sources. And we’re going to begin with the alphabet soup that is ETL (extract, transform, and load).

Automated Data Extraction

Extraction is where your effective data management dreams begin. Now, the exact tactics you use – or more like an experienced third-party use – depends on the level of access to the underlying database.

For example, if either the server is on-premises or you have access to a computer directly linked to the database, you simply grab an open database connection, log into the host site or database, and extract the data directly from the schema on the backend of the system.

For a cloud-based data repository, you use an API (application programming interface) that allows two computers to talk to each other and proceed in the same way – accessing the database schema and extracting the information.

Whether on-prem or cloud-based, your extraction process is the opposite of the GUI (graphic user interface) your business users are accustomed to accessing at the front end of the system. That’s the one where they enter dates, maybe search terms in the GUI, press enter, and hope for the best.

Sometimes, however, you don’t have direct access to the backend of the database. In these cases, you’ll probably use an RPA bot (robotic process automation) to log into a bank account, for example, and pull down the information from there.

Thus, to extract your data, you’re either pulling it straight from the information schema in a database or through an automated bot interfacing with a website or some other protected data source system.

Transforming and Loading the Data

Once you’ve extracted the data, you typically transform it by landing it somewhere between its original sources and your endpoint, whatever that might be. This landing spot is ideally a database or data warehouse of some sort, therefore minimizing or eliminating manual manipulation of the data while still allowing you to tweak it as necessary.

This ETL strategy allows you to automate the extraction process, clean up the data, and load it without affecting the source data. And that leaves you with the best of both worlds – unfettered access to the entity-level data while still providing consolidated reports for maximum transparency.

Don’t Forget About the ROI

You didn’t think we’d dangle the ROI carrot up top and then never follow through, did you? We’ll preface our discussion on ROI and digital transformation in general by stating your breakeven will always depend on the scale of the projects you undertake.

That said, return is almost immediate for these financial data management solutions, particularly for the small to medium-scale ones. In fact, it’s not uncommon for enterprises to see these projects pay for themselves within a year, making all of the ongoing ROI pure gravy.

In most cases, you’ll realize return on three distinct fronts:

- A drastic reduction in time decision across the organization

- Reducing or eliminating the need for an internal audit

- A significant drop in employee turnover

Needless to say, the more comprehensive and sweeping your commitment to a transformation is, the more you’ll reap in the long-term. Still, given the short breakeven points to positive ROI, costs typically aren’t a primary focus in those low hanging, small-to-midsize projects like consolidating data sources.

Data Automation and Your People

That last ROI bullet point – a significant drop in employee turnover – often catches people off guard since most tend to associate automated workflows, data analytics, and other transformation–oriented technologies as job killers. The reality, however, is much different than you might think.

While these improvements to your data management certainly reduce your need to significantly expand your headcount in the future, the impact on your current employee base is more subtle. For the most part, your people will move their focus from manual business processes to analysis, upscaling as they go.

Put another way, employees will learn new skills and expand their roles, injecting a far more innovative, forward-looking perspective to your operations. Therefore, you’ll retain and attract key talent since your people want to grow their skill set and challenge themselves, a trait that makes your organization especially attractive to potential candidates.

Ultimately, every CFO – from financial services to widget manufacturers – can use these tools and tactics to streamline data management processes, strengthen their enterprise, and create a competitive advantage. But as with most things in life, it’s just a matter of doing it.

The good news, however, is that Embark is ready, willing, and able to lend you our experience and expertise in this area , helping propel your organization toward a much brighter future. And isn’t that what every CFO wants to accomplish for their company in the first place?